Greeks.Live & Deribit Options Market Observation 0629 —The Skew of ETH and BTC

Remarks:

The short-term left-skew of ETH continues to be lower than BTC .There are more active and larger trading groups in the BTC options market, and their views reflected in the price more prominently.

This report is jointly published by Deribit and Greeks.Live.

【Performance of the underlying assets】

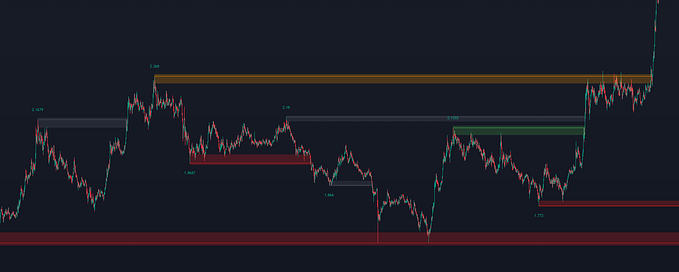

BTC historical volatility:

7d 25.94%

14d 31.90%

30d 50.97%

60d 60.80%

1Y 86.21%

ETH historical volatility:

7d 35.90%

14d 46.41%

30d 57.04%

60d 68.25%

1Y 103.45%

The historical volatility of Bitcoin and Ethereum continues to prevail at low levels. In recent years, the period similar to the current low volatility is not too much. The volatility in November 18, March 19, and September 19 was very low.

【BTC Options】

Open interest was 693 million US dollars, down 46.7% from the 1.3 billion US dollars before the delivery on June 26.

The market is bland, and the market’s indifference makes the position expansion not fast.

The implied volatility (IV) of each standardized expiry date is as follows:

Today: 1m 53%, 3m 65%, 6m 72%

6/28:1m 54%, 3m 66%, 6m 73%

IV has been falling for some days.

Skew:

Today: 1m -15%, 3m -4.8%, 6m +2.0%

6/28:1m -15%, 3m -5.5%, 6m +2.2%

The left-skew has been obvious in short term, and it seems that the protection demand has pushed up the price of Put.

The Put/Call Ratio has reached 0.48, lower than the average ratio of the past 3 months.

The newly opened positions in the head are concentrated on the short-term option, and the amount of Call is more.

From the data of Open Interest, 31Jul and 25Sep are the most popular options.The reason of this is that the traders moved their positions.

【ETH Options】

ETH options open interest is USD 119 million, remaining at a high level in the view of long-term.

The trading volume has been stable.

The IV of each standardized expiry date:

Today: 1m 51%,3m 65%,6m 71%

6/28:1m 53%,3m 65%,6m 72%

IV has been stable,and IV of ETH is close to the level of BTC.

Skew:

Today: 1m -5.8%, 3m +3.9%, 6m +7.6%

6/28:1m -6.2%, 3m +1.9%, 6m +5.4%

The skew has been stable.

The Put/Call Ratio of the open interest has reached 1.02, a high level over the past six months.

Jeff Liang

CEO of Greeks.Live

June 29, 2020