Greeks.Live & Deribit Options Market Observation 0714 — Volatility Risk Premium

Remarks:

The volatility risk premium(VRP), which is the difference between implied volatility and historical volatility, or VRP = IV-RV.Just as the basis between currency and futures, a positive VRP will give the seller the desired positive return.

This report is jointly published by Deribit and Greeks. Live.

【Performance of the underlying assets】

BTC historical volatility:

7d 23.59%

14d 25.36%

30d 44.81%

60d 48.35%

1Y 83.84%

ETH historical volatility:

7d 32.83%

14d 42.51%

30d 44.81%

60d 60.20%

1Y 101.60%

Bitcoin is at the end of a triangle with very low volatility levels and trading volumes, but short-term options are trading significantly higher.

【BTC Options】

BTC options open interest was down slightly at $984 million.

The implied volatility (IV) of each standardized expiry date is as follows:

Today: 1m 54%, 3m 66%, 6m 72%

7/13: 1m 54%, 3m 66%, 6m 73%

The market’s VRP has been negative for some time now, and it seems riskier for sellers to sell without the airbag of VRP.

For buyers, the cost of buying options appears to be lower with negative VRP. But in terms of results, the sellers win.

Skew:

Today: 1m +1.5%, 3m +2.9%, 6m +4.1%

7/13:1m -0.8%, 3m +3.2%, 6m +5.1%

Yesterday buy Call traded heavily, today buy put traded heavily.

PCR

The Put/Call Ratio is 0.52.

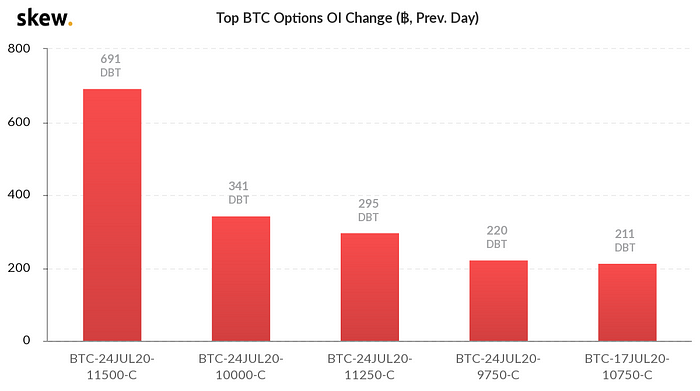

In terms of position changes, a large number of OTM calls options were traded yesterday and a large number of OTM puts are traded today.

The distribution of positions is shown in the chart, with the current week and the following week being the main drivers of trading.

【ETH Options】

ETH options open interest is USD 158 million.

Trading volumes are stable.

The IV of each standardized expiry date:

Today: 1m 56%,3m 68%,6m 74%

7/13: 1m 59%,3m 69%,6m 75%

Short-term volatility rises slowly.

Skew:

Today: 1m +3.2%, 3m +9.6%, 6m +11.1%

7/13: 1m +7.8%, 3m +8.7%, 6m +7.8%

Short term OTM options were very heavily traded, yesterday it was call and today it’s put, and it appears that some traders bought the covered call first and then bought puts to synthesize a short position.

Have a good time.

Jeff Liang

CEO of Greeks.Live

July 14, 2020