Greeks.Live & Deribit Options Market Observation 0715 — Reverse Calendar Spread

Remarks:

In a previous article, we discussed calendar spreads. By opening interest with different expiry at the same strike price. Selling the short-term and buying the long-term is the calendar spread. There is currently a large gap between short-term IV and long-term IV, and when the market moves, short-term volatility changes tend to be greater than long-term volatility, so it may be a good idea to open a reverse calendar spread.

This report is jointly published by Deribit and Greeks. Live.

【Performance of the underlying assets】

BTC historical volatility:

10d 27%

30d 29%

90d 61%

1Y 81%

ETH historical volatility:

10d 46%

30d 44%

90d 72%

1Y 101%

The current RV of short-term bitcoin options is significantly lower than IV, while the RV of medium- and long-term contracts is slightly lower than IV. This is because in recent times The RV is indeed below average, due to the reluctance of sellers to continue lowering their selling prices.

【BTC Options】

BTC options open interest was down slightly at $1.0 billion.

The implied volatility (IV) of each standardized expiry date is as follows:

Today: 1m 53%, 3m 66%, 6m 72%

7/14: 1m 54%, 3m 66%, 6m 72%

Implied volatility is unchanged from yesterday, for the short term remains around 54% and the long term remains around 72%, a difference of 18% between the two It is also already among the larger gaps in the historical data.

Skew:

Today:1m -2.8%, 3m +0.9%, 6m +3.5%

7/14:1m -1.5%, 3m +2.9%, 6m +4.1%

PCR

The Put/Call Ratio is 0.52.

In terms of position changes, trading volumes are lower than before.

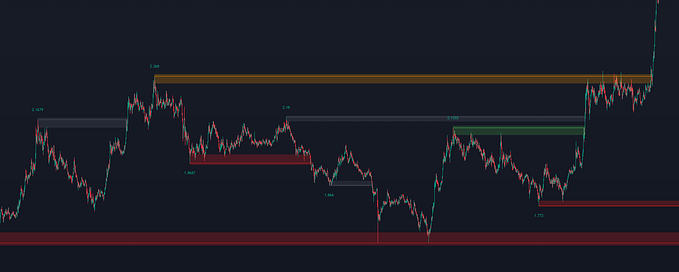

The distribution of positions is shown in the chart, with More than 50,000 BTC of options positions expiring on the 31st. Short- and medium-term options positions grow at the fastest rate.

【ETH Options】

ETH options open interest is USD 163million.

Trading volumes are stable.

The IV of each standardized expiry date:

Today: 1m 55%,3m 67%,6m 74%

7/14: 1m 56%,3m 68%,6m 74%

The short-term volatility rises slowly and the long-term volatility is stable.

Skew:

1m +3.2%, 3m +9.6%, 6m +11.1%

7/13: 1m +6.4%, 3m +11.7%, 6m +10.8%

ETH’s data is increasingly diverging from BTC’s, and there may be opportunities to trade in different coins.

Have a good time.

Jeff Liang

CEO of Greeks.Live

July 15, 2020