Greeks.Live & Deribit Options Market Observation 0722–Left-Skew Pulls Back

Remarks:

Bitcoin has been in a significantly left-skew state lately, and the rise of Bitcoin price brought Skew back quickly yesterday. The ethereum market, however, is behaving differently, that the skew has only returned to near zero after the rise. The options markets for Bitcoin and Ethereum are becoming increasingly different, in terms of volume, trade distribution, and several other data points.

This report is jointly published by Deribit and Greeks. Live.

【Performance of the underlying assets】

BTC historical volatility:

10d 18%

30d 29%

90d 58%

1Y 81%

ETH historical volatility:

10d 34%

30d 46%

90d 64%

1Y 100%

Historical volatility is at a record low, and there are two points about the low HV. One is a small price move, the other is that most time the market is in sideways.

【BTC Options】

BTC options open interest was down slightly at $1.2billion.

The implied volatility (IV) of each standardized expiry date is as follows:

Today: 1m 49%, 3m 62%, 6m 70%

7/21:1m 50%, 3m 62%, 6m 70%

The short-term implied volatility had risen for 2 hours and then fell to 50%.

The mid- and long-term implied volatility has been more stable.

Skew:

Today:1m -10.0%, 3m -3.1%, 6m +0.4%

7/21:1m -3.4%, 3m +1.3%, 6m +0.6%

The most significant change in today’s data is the fall of short-term Skew to 3.4%, which has been hovering around 10% recently. As mentioned in a recent observation, Skew is at a relatively high level, and with the price of Bitcoin rising today, short-term Skew has clearly Pulls Back.

Flows:

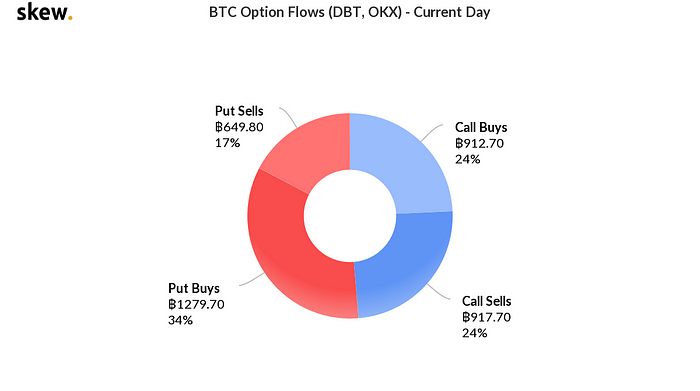

The Put/Call Ratio is 0.52. The four trading forces were relatively close today, and the block trade was quiet again, with only three trades at the price of 8,500p.

OI Change

In terms of position changes, the options with the largest trading volume are 8500Put.

The distribution of positions is shown in the chart, with open interest surpassing 59,000 BTC at the end of the month for 31Jul-expiry.

【ETH Options】

ETH options open interest is USD 183 million. With the open interest exceeding that of Jun26-expiry significantly, with the short term options position in Eth rising.

The IV of each standardized expiry date:

Today: 1m 54%,3m 67%,6m 75%

7/21: 1m 52%,3m 67%,6m 74%

The short-term volatility and long-term volatility are both stable.

Skew:

today:1m -4.3%, 3m +7.6%, 6m +8.0%

7/21: 1m -1.6%, 3m +6.1%, 6m +6.1%

For the ETH market, the skew is stable,which is different from BTC.

Have a good time.

Jeff Liang

CEO of Greeks. Live

July 22, 2020